What if I’m in a Car Accident With an Uninsured Motorist in Colorado?

Our Denver car accident attorneys have extensive experience handling injury cases. It doesn’t matter if you have a minor scrape or a major collision, we are here for you.

Car accidents occur pretty much around the clock. Statistics show that in the time it will take me to finish this sentence, another car accident will have occurred somewhere in the U.S.

In many cases, these accidents are relatively minor. Sometimes the damage is so minimal that it’s easier to just pay the costs out of pocket. But if the accident is more serious, the at-fault driver’s insurance will end up having to step-in to help cover your medical expenses, property damage and lost wages.

But what happens when the other driver doesn’t have insurance?

According to the Insurance Information Institute, 12.6% of U.S. motorists (or about 1 in 8 drivers) were uninsured in 2019. Colorado, ranked 13th in the country among states with the highest number of uninsured drivers, was higher than the national average, with an estimated 16.3% of uninsured motorists.

As with every other state, Colorado laws require that any owner of a car, truck, motorcycle or any other motor vehicle have a minimum amount of insurance in the event of an auto accident. Many drivers, however, are either uninsured or underinsured—they may have either let their policies lapse because they weren’t able to pay, or the policies they have simply aren’t enough to compensate for the resulting injuries and damages.

So when someone gets into a car accident with an uninsured or underinsured driver in Colorado, they will likely have many questions on their mind, such as:

- What happens if the other driver has no insurance?

- Who will pay for my injuries and/or damages?

- What is uninsured motorist (UM) or underinsured motorist (UIM) coverage?

- What if my insurance company refuses to pay for the other driver’s negligence?

- When can I file a personal injury lawsuit against an uninsured/underinsured driver?

- What should I do next?

As a Colorado car accident attorney, I want you to know your rights in the event you’re involved in a car accident in Colorado where an uninsured motorist is at fault. Get your questions answered.

First, though, you should understand how insurance normally protects you in these situations.

What are Colorado uninsured motorist laws & insurance requirements?

All car insurance carriers in Colorado are required to offer you uninsured/underinsured motorist coverage when you purchase a policy, which covers you and your passengers if you get into a car accident with an uninsured motorist. You’re not required to purchase it (provided you submit a written statement to your insurance company turning it down).

Insurance coverage for Colorado motorists is broken into 2 parts:

- Bodily injury coverage (injuries)

- Property damage coverage (damage to your vehicle)

Colorado requires every owner of a passenger vehicle (car or truck) to be insured for at least $25,000 per person ($50,000 per accident) in bodily injury liability and $15,000 in property damage per accident.

As of January 2008, Colorado passed a law effectively closing loopholes previously used by insurers to prevent “offsetting” and using “anti-stacking” language. The law was intended to help ensure Coloradans could obtain the full scope of benefits they expected to receive when buying UM/UIM coverage in Colorado.

Colorado was a “no-fault” state until 2003, but the law has since been changed. The state now operates under a tort system, meaning fault for the accident must be established before an insurance company is forced to pay a claim.

What is Comparative Fault?

When an accident occurs, drivers often start pointing fingers. Learn how your percentage of fault will impact your compensation after a car accident in Colorado.

What should I do if an uninsured driver runs into me in Colorado?

Car accidents are difficult enough when everything works as it should. If the other driver is at fault, their insurance should pay to make you “whole” again—meaning you should be compensated for damage to your vehicle, medical expenses and lost wages for any time you were out of work.

However, colliding with an uninsured or underinsured motorist adds a whole new dimension to the situation. If this happens, do the following:

- Obtain contact information from the other driver, including any insurance information they have, and give it to your insurance company.

- Some insurance companies require you to obtain a signed statement from an uninsured driver stating they have no insurance. If yours does, get a signed statement from the other driver.

- Submit a claim after obtaining the above information and statement to your own car insurance provider. If the other driver was underinsured, their carrier will compensate up to their policy limits, and you can then make a claim to your insurance company for the balance.

IMPORTANT NOTE:

Before accepting any settlement from an at-fault driver’s insurance carrier, check with your own insurance company first. Most Colorado car accident insurance policies stipulate that you must obtain permission before accepting any settlements. If you accept any settlements without checking with them first and your policy contains this contract provision, you may not be able to submit an underinsured claim to your own insurance company.

What if my insurance company doesn’t want to pay for an uninsured car accident?

Dealing with a car accident where the other driver is at fault and uninsured may end up pitting you against your own insurance company. They may argue that you were partially at fault for the accident or debate the extent of your injuries that they’re responsible for compensating you for. Even if you were slightly at fault, they may reduce your compensation.

Here are the steps you should take to protect your rights if your insurance company is refusing to pay:

- Review your policy. Firstly, go through your insurance policy to understand what types of coverage you have and whether uninsured motorist coverage is included. Make sure you understand all terms, conditions and exclusions.

- Gather evidence. Collect all relevant documents, such as the accident report, photographs of the scene and damages, medical reports if you’ve sustained injuries, and any correspondence with the insurance company.

- Consult with an attorney. Next, you may want to consult with a Colorado car accident lawyer who can review your policy and explain your legal options for pursuing compensation.

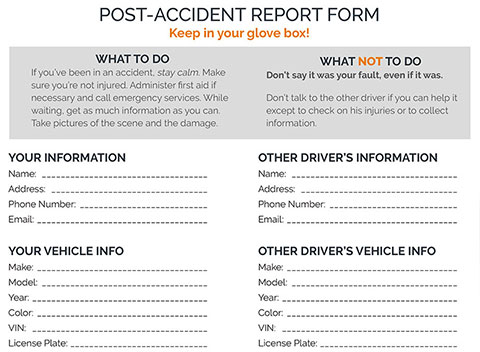

Download Car Accident Guide and Other Forms (PDFs)

Schedule your free, no-risk consultation today with an experienced Colorado uninsured car accident attorney

Discuss the details of your claim with a Colorado auto accident attorney at The Babcock Law Firm today. No matter where you are in the state of Colorado, if your case falls within our practice area and we feel our representation can benefit you, one of our skilled attorneys will conduct an in-depth consultation at no charge.

We are here to help you secure the best possible outcome. Contact us today and learn more about how representation works.